OCBC Great Eastern Credit Card

OCBC GE Credit Card is the life-time credit card specially designed for Great Eastern Life insurance policy holders.

Are you amazed by the above privileged? And, say, if you are already a family member of GE Life insurance, Then, getting this credit card is as simple as in below:

Follow the step below as we browse you through understanding!

Step 1: Benefits of OCBC GE Card for GE Policy Holders

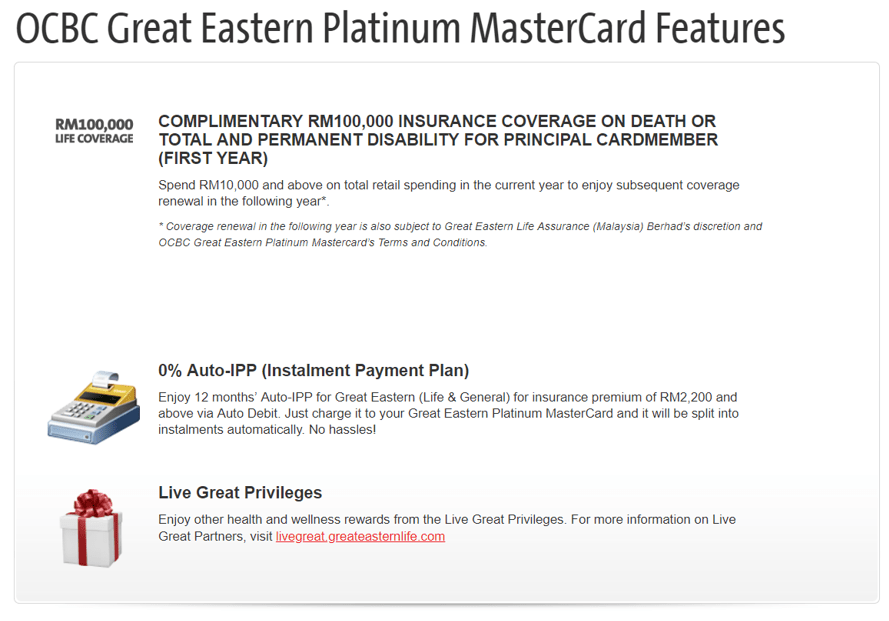

- ADDITIONAL Life insurance PROTECTION

- There is NO ADDITIONAL CHARGES FOR online payment.

- Elimination of policy lapsed in case of unsuccessful policy payment transaction.

- For Traditional policy – pay yearly premium but ENJOY monthly installment without interest charged.

- Benefits of recurring GE premium policies for the IPP feature

- ADDITIONAL offers from LIVE GREAT partners e.g. (GNC Livewell, BP Healthcare, Himalaya, OTO wellness etc.)

Step 2: Process of Income Submission Document/Documents to be submitted

|

Salaried Employees / Salaried Company Directors (Sdn Bhd) |

Permanent Employee: § Latest EPF Statement with at least past 6 months contribution New Joiners: § Latest pay slip and bank statement showing salary being credited (to recognize basic salary only) |

|

Commission Earner (Non GE agent) |

Ø Borang B / BE / eFiliing (with validated receipt of payment to LHDN) OR Ø Latest 6 months commission statement supported by bank statement |

|

Self Employed / Business Partner |

Non-exemption from Tax: § Latest Form B / BE / eFiling with validated Tax Receipt (inclusive of PCB); AND Latest consecutive 3 months bank statement Exemption from Tax: § Latest Form B / BE / eFiling showing exemption from Tax AND Latest consecutive 8 months company account’s bank statement |

|

Company Directors (Sdn Bhd) |

Ø Latest Form B / BE / eFiling with validated Tax Receipt (include of PCB); OR Ø Latest EPF statement; OR Ø Latest EPF statement and Pay slip with EPF contribution + Bank statement to evidence variable income being credited if not subject to EPF deduction; OR Ø Latest 6 months company bank statements (T&C applied) |

|

Civil Servants |

With Pension Scheme § Latest 3 months’ pay slip and latest 3 months bank statement Without Pension Scheme § Latest EPF |

|

Doctors/ Surgeon/ Dentists |

Ø Latest 6 months invoices / payslips supported by bank statement (T&C applied) Ø Borang B / BE/ eFiliing (with validated receipt of payment to LHDN) |

|

Foreign bank statement for evidence of income or AUM |

Ø Foreign bank statements from major / well-known foreign banks in Singapore, China, Hong Kong, Indonesia, UK and Australia or OCBC Group of Companies in any other markets. Ø Other markets to be considered on case to case by Credit Signer from CCD and this will not be treated as a deviation. |

|

Without any source of Income Documentation |

With FD Lien § Pledge FD Lien, 1-to-1 basis, minimum RM3k Without FD Lien § Net Personal Asset (NPA) must be >RM1m with OCBC for minimum 6 months |

|

Malaysians working in Singapore or Brunei |

Ø Latest 1 month payslip + bank statement; OR Ø Latest 3 months payslip + bank statement (for variable income recognition) Ø CPF statement mandatory for Salaried Singaporean and Malaysian with Singapore PR Ø Notice of Assessment (NOA) [Non Cored Doc] ( Optional)

*Copyright from OCBC GE Credit Card Broucher |

Step 3: Download Application Form

Step 4: Submit the Application Form and Income Document via below

Please email the submission form & income document to info@samivalue.com.my.my

Step 5: Understanding Application Process

Step 6: Claim Process

- Please find the claim forms and checklist for claims submission at Great Eastern Life Malaysia

- Fill up the forms and submit the documents in person at GELM Head Office Customer Service Centre or the nearest GELM branch office or to your servicing agent.

- End to end claims processing of 14 working days from the receipt of last completed claims documentation, subject to the Company conducting any investigation due to suicide or Pre-existing Illness or examining the body and conducting autopsy before making any payment under the Policy.

- Total Permanent Disability (TPD) claim payable to Assured Member

- Death claim payable to Legal administrator / legal executor upon submission of Letter of Administration / or Grant of Probate. Unclaimed monies after 1 year will be deposited to UMA (UMA 1965 requirement).